By: Penelope Graham, Zoocasa

It’s not a new narrative that Canada’s largest urban housing markets have been plagued by eroding affordability. However, a new set of data that pits income tax filings against home prices reveals just how financially steep homeownership can be; even taking into account recent market corrections in Vancouver and Toronto, owning the average abode is possible only for an elite echelon of income earners in these cities.

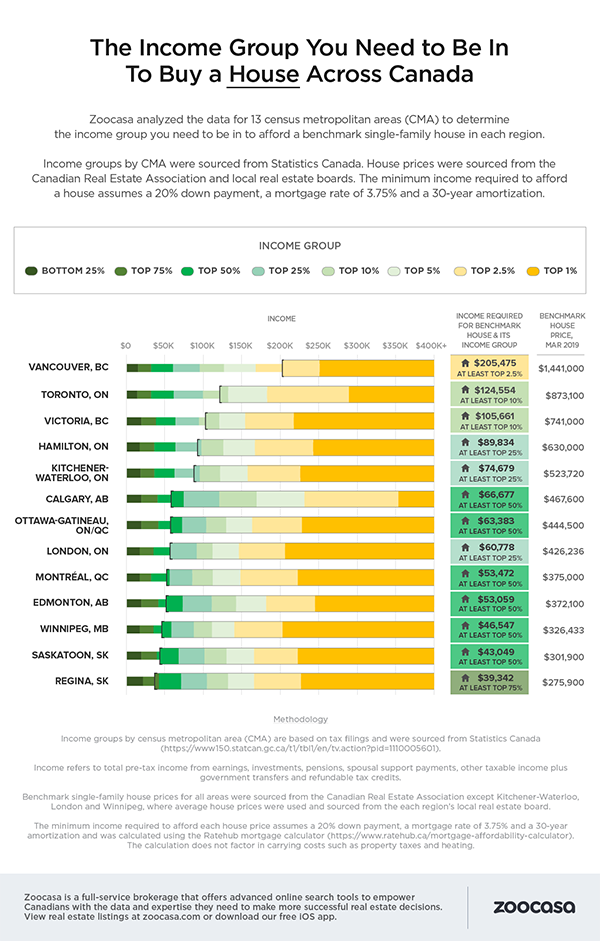

The numbers, which were analyzed by the Zoocasa team, calculated the minimum income required to afford an average home in 13 Census Metropolitan Areas (CMAs), and then compared them to income filings as reported by Statistics Canada to identify the income threshold buyers would need to fall within in each market. A mortgage calculation, which assumed a 3.75% mortgage rate, 20% down payment, and 30-year amortization, was used to determine the minimum income required to purchase a house (including attached, detached and freehold row homes) as well as apartments (including condos and townhouses).

Only Elite-Level Earners Can Afford Single-Family Homes

For hopeful prospective buyers in Canada’s largest cities, the data is disheartening, especially for those looking to get into the single-family segment; those looking to buy a house in Toronto at the average price of $873,100 would need to be among the top 10 per cent of income earners in the city. In Vancouver, where houses cost an average of $1,441,000, that threshold narrows dramatically to within the top 2.5%.

These numbers likely don’t come as a surprise – it has long been common knowledge that houses for sale in Vancouver or Toronto can be prohibitively expensive, prompting first-time and millennial buyers to gravitate to multi-family housing options, such as condos and townhouses, as more financially viable options.

First-Time Buyer Options Are Also Financially Out of Reach

However, the data reveals that the affordability window for these housing types is also rapidly closing. In Toronto, where the average apartment unit costs $522,300, a buyer would still need to earn an income within at least the top 25% of the city’s income threshold. That’s the same requirement as in Vancouver and Victoria, where average units cost $656,900 and $497,100, respectively.

Prairie and Secondary Ontario Markets Offer Price Relief

The study throws into sharp relief just how varied affordability can be in markets across the country – the good news is, for buyers looking in Ontario’s secondary markets or in the Prairies, homeownership is much easier to grasp. Compared to Toronto and Vancouver, those earning an income within the top 50% could afford to purchase the average house in Calgary ($467,600), Ottawa-Gatineau ($444,500), Montreal ($375,000), Edmonton ($372,100), Winnipeg ($326,433), and Saskatoon ($301,900). The most affordable city of all for a single-family home is Regina where, at an average price of $275,900, a property is within reach of the top 75% of income earners.

These cities are also far more financially friendly for those looking to enter the market at a lower price point – an apartment can be considered affordable for the top 75% within Regina, Saskatoon, Winnipeg, Edmonton, and Calgary, and for the top 50% in an additional five: Montreal, London, Ottawa, Kitchener-Waterloo, and Hamilton.

What Does This Mean for Home Buyers?

The numbers highlight the growing disconnect between wages and prices for MLS listings in Toronto and Vancouver, but also reveal the extent the price gap between housing types is shrinking. With only the top quarter of buyers able to buy the average starter home in Canada’s biggest cities, trends such as market spillover will continue to nearby commuter communities. For example, according to a study released in 2017 by the Canada Mortgage and Housing Corporation, priced-out buyers in Ontario travel as far as Niagara to improve affordability, while in BC, regions such as the Okanagan Valley have become magnets for would-be homeowners.

Check out the infographics below to see which income tier buyers must be in to afford houses and apartments across Canada: